This report presents the findings of an international study conducted by Kestria Institute to explore global compensation trends. The aims of the study were to:

- examine the influence of factors such as company size, industry, and geography on remuneration trends

- explore the use of non-traditional remuneration in different regions and industries;

- gain insights into the executives' perceptions and expectations regarding compensation practices.

The insights generated were organised under the following key themes:

- Salary adjustments

- Transparency

- ESG

- Diversity

- Special benefits over and above traditional compensation

The data was collected by surveying over 400 respondents and the results were segmented into region, company size and industry categories. While efforts were made to ensure the validity and reliability of the data and to account for unequal sample sizes between categories, interpretations should be made with consideration for the limitations inherent in survey research. Additionally, it is important to note that, as an alliance of executive search firms, Kestria has access to senior-level employees and, while some survey items addressed company-wide trends, they largely pertained to executive compensation.

Segmentation categories

Respondents represented 45 countries and were segmented into:

- Africa

- Asia-Pacific

- Americas (comprising mainly the US and Canada)

- Europe

Pre-selected industry categories were:

- Agribusiness and agriscience

- Banking and financial services

- Consumer and retail

- Energy, natural resources and infrastructure

- Healthcare and life sciences

- Industrial / production

- NGO / NPO / education

- Professional services

- Technology

Additional industry categories that did not yield sufficient responses were either discarded or rolled up into the above-mentioned categories so as to generate more meaningful insights.

Companies were segmented into the following size categories:

- Small (0 – 1000 employees worldwide)

- Medium (1001 – 10000 employees worldwide)

- Large (over 10000 employees worldwide)

Salary adjustments

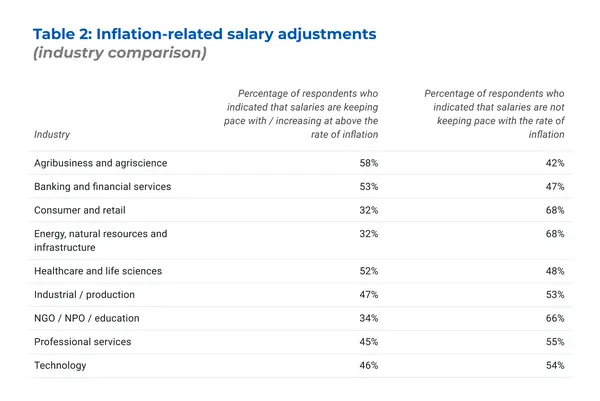

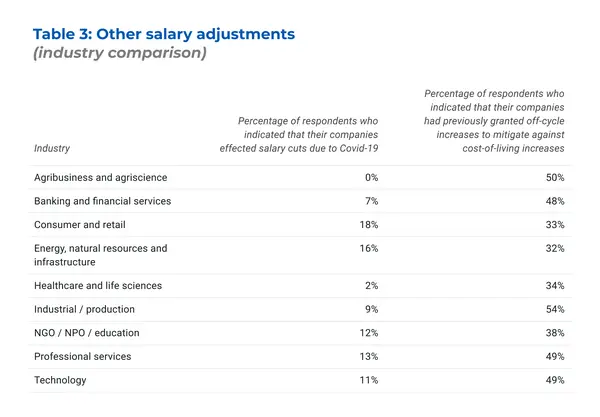

This section addresses salary adjustments in relation to events outside of an employee’s career-related progression e.g., inflation, cost-of-living increases and Covid-19.

Respondents were asked a specific question regarding their perception of salary growth in relation to inflation and the results aggregated, revealing interesting regional differences. In the Americas, Africa and Europe, the majority of respondents believe that salaries are not keeping pace with inflation. Conversely, in Asia-Pacific, the respondents have a more balanced perception, with over two thirds of respondents reporting that salaries are keeping pace with, or are above inflation.